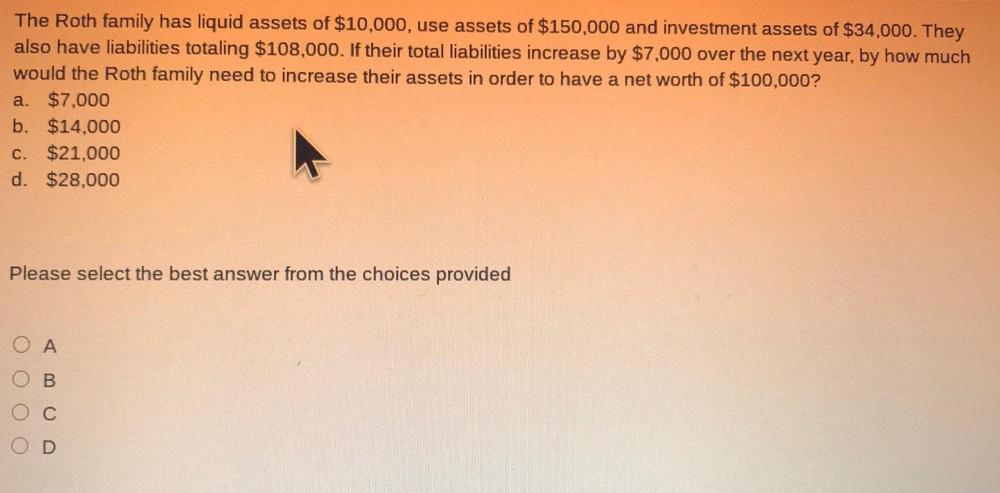

The roth family has liquid assets of 10000 – The Roth family has liquid assets of $10,000, a significant financial milestone that presents both opportunities and challenges. This detailed analysis will delve into the implications of their liquid assets, exploring strategies for effective management and investment.

Understanding the role of liquid assets in personal finance is crucial for informed decision-making. Liquid assets provide flexibility and security, enabling individuals to meet short-term financial obligations and pursue long-term goals.

1. Liquidity Assessment

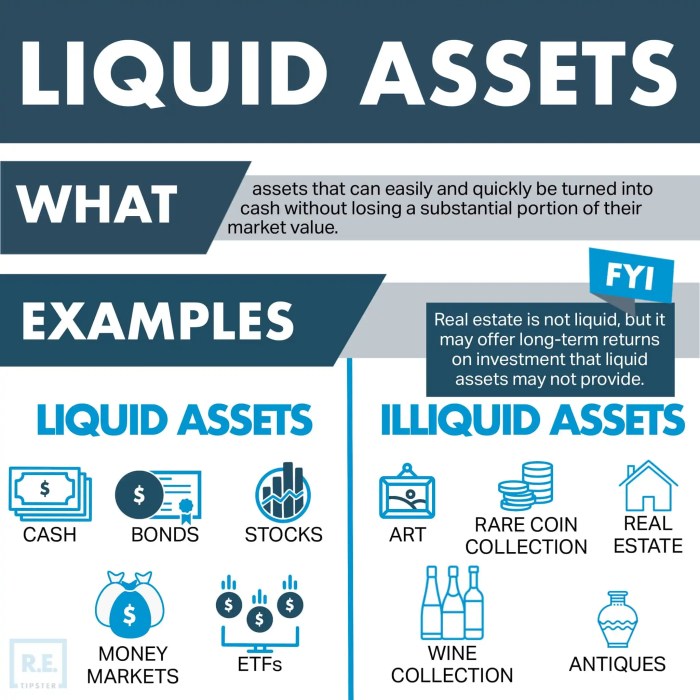

Liquid assets refer to financial assets that can be easily converted into cash without incurring significant losses or delays. They play a crucial role in personal finance, providing a buffer against unexpected expenses, funding short-term goals, and maintaining financial stability.

Examples of liquid assets include:

- Cash

- Demand deposits (checking and savings accounts)

- Money market accounts

- Certificates of deposit (CDs)

- Short-term Treasury bills

2. Financial Planning Implications: The Roth Family Has Liquid Assets Of 10000

Short-Term Financial Goals, The roth family has liquid assets of 10000

Liquid assets are essential for achieving short-term financial goals, such as:

- Covering unexpected expenses

- Making large purchases

- Funding short-term investments

Long-Term Financial Planning

While not as critical for long-term financial planning as growth-oriented investments, liquid assets still play a role:

- Providing a buffer against market volatility

- Funding retirement expenses

- Maintaining financial stability during emergencies

Managing Liquid Assets

Effective management of liquid assets involves:

- Maintaining an adequate balance to cover short-term needs

- Diversifying across different types of liquid assets

- Considering tax implications and risk tolerance

3. Investment Options

Suitable investment options for liquid assets include:

- High-yield savings accounts

- Money market mutual funds

- Short-term bonds

- CDs with maturities of less than one year

The choice of investment vehicle depends on factors such as risk tolerance, return potential, and investment horizon.

4. Tax Considerations

Liquid assets are subject to taxation depending on their nature and the tax laws applicable:

- Interest earned on liquid assets is typically taxed as ordinary income.

- Capital gains from the sale of liquid assets may be subject to capital gains tax.

- Some liquid assets, such as tax-free savings accounts, offer tax advantages.

5. Risk Management

Holding liquid assets also carries certain risks:

- Inflation risk: The value of liquid assets may erode over time due to inflation.

- Market risk: The value of liquid assets invested in the market may fluctuate.

- Counterparty risk: The issuer of liquid assets may default, leading to losses.

Diversification and prudent investment strategies can help mitigate these risks.

6. Case Study

Roth Family

The Roth family has liquid assets of $10,000. Their financial goals include saving for a down payment on a house and funding their children’s education.

Recommendations:

- Maintain a portion of the liquid assets in a high-yield savings account for easy access.

- Invest a portion in short-term bonds or CDs to earn a higher return while preserving capital.

- Consider a tax-free savings account for long-term savings.

- Diversify across different types of liquid assets to manage risk.

Top FAQs

What are the benefits of holding liquid assets?

Liquid assets offer flexibility, ease of access, and security, providing a buffer against unexpected expenses and emergencies.

How can the Roth family optimize their investment returns on liquid assets?

Diversification, asset allocation, and regular monitoring can help the Roth family maximize their returns while managing risks.

What tax considerations should the Roth family be aware of?

Tax implications vary depending on the type of liquid assets held. The Roth family should consult with a tax professional for personalized advice.